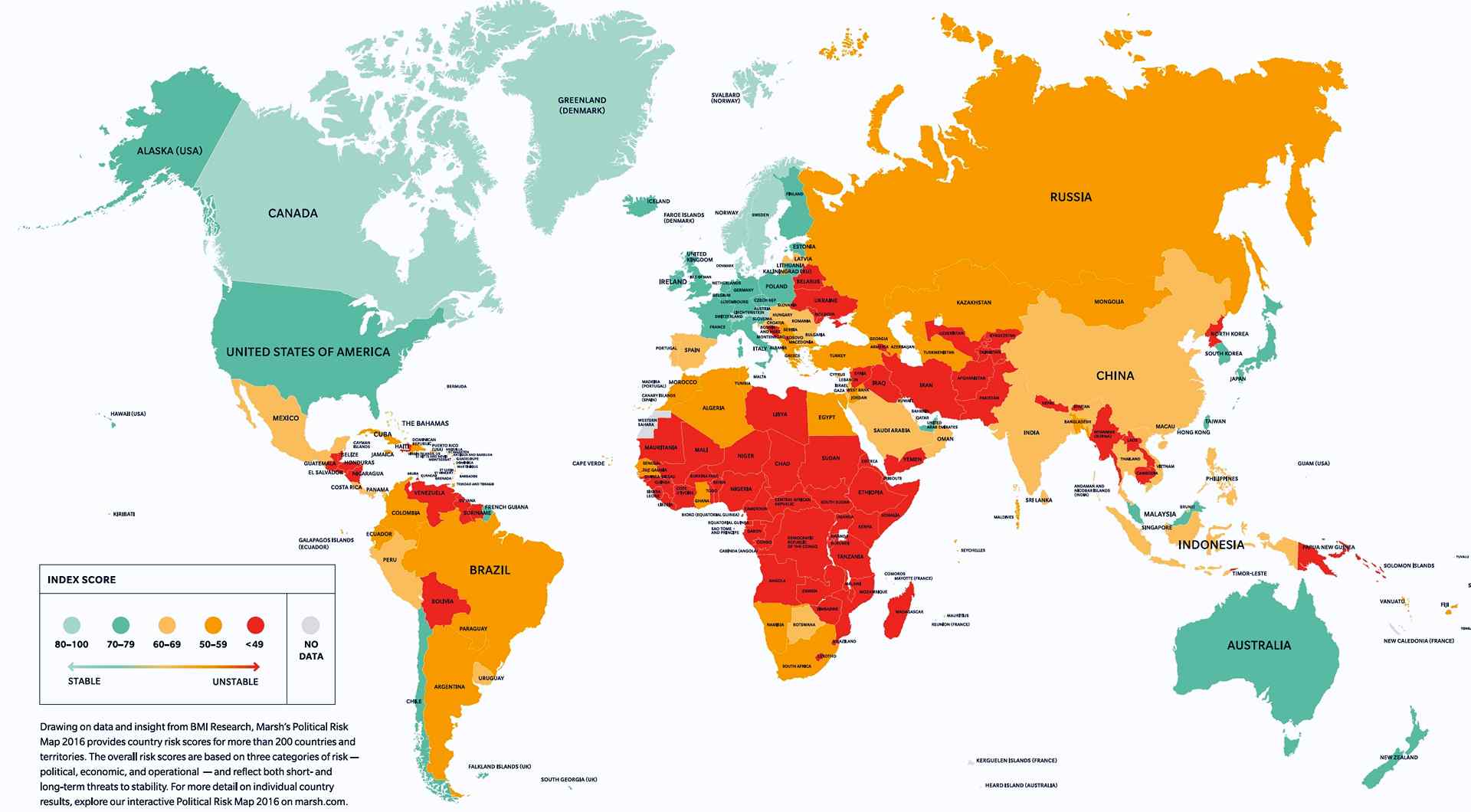

Emerging markets present lucrative growth opportunities, yet multinational corporations often underestimate the hidden costs of security risks that erode return on investment (ROI). While companies focus on immediate threats, they frequently overlook the long-term financial impact of instability, including supply chain disruptions, operational risks, and personnel safety challenges. These risks lead to direct economic losses and create cascading effects that can turn high-potential investments into costly liabilities.

Supply chain disruptions pose one of the most significant threats to profitability in emerging markets. Companies relying on local sourcing, manufacturing, and transportation often face security challenges such as:

These risks are even greater for mining and resource extraction companies. Operating in remote, unstable locations requires extensive security measures, from site protection and raw material transportation to securing high-value equipment. Many firms establish costly parallel supply chains as contingency measures yet still struggle with delays and quality control issues.

Corporations with sales and distribution networks in high-risk regions face direct security threats that significantly impact profitability. A prime example is South Africa’s booming e-commerce sector, where delivery companies report daily 20-25 vehicle hijackings. Firms transport high-value goods using cash-in-transit vehicles to mitigate these risks, incurring substantial costs that erode profit margins.

The July 2021 riots in KwaZulu-Natal illustrate the devastating financial impact of instability. The R50 billion economic losses resulted from large-scale attacks on warehouses and distribution networks, including UPL South Africa's operations. The aftermath required 130 security and remediation specialists working around the clock, with expenses spanning environmental cleanup, supply chain reconfiguration, and community relations.

For industries like mining, oil, and gas, security risks extend beyond infrastructure to targeted violence against personnel.

These threats force companies to invest in armoured vehicles, advanced surveillance technology, and private armed security, further increasing operational costs. Moreover, the need for executive crisis management diverts strategic focus, creating hidden opportunity costs that rarely factor into initial investment decisions.

Savvy executives now recognise that comprehensive security intelligence is a strategic investment, not just an expense. The question is no longer whether companies can afford sophisticated risk mitigation strategies but whether they can afford not to have them.

By shifting from reactive security measures to proactive risk management, multinational corporations can:

Ultimately, businesses that integrate security into their core strategy will unlock emerging markets' true potential while protecting their bottom line.